Money laundering means using illegal money for a legal purpose. Money earned through banned activities like drug trafficking, terrorism, gold smuggling etc are illegal money. If money earned by such means is used for setting up business, buying property, travelling etc. will amount to money laundering. It is an offence. It is a criminal act.

Why it is banned?

The economy of all countries are regulated by the Central Bank and Government of the country. The Government list out the activities which are permitted to carry out in the society. There are certain activities which are not permitted considering its ill effect on the society.

Therefore anybody carrying out such activities are against the rule of the Government. It is also against the social good. When somebody carries out such activity it creates a parallel economy. Money generated by such activity being illegal is not part of the money that Government controls. When such money is utilized for legal purpose or government permitted purposes it creates disruption in the economy. Therefore it is banned.

Stages of Money Laundering

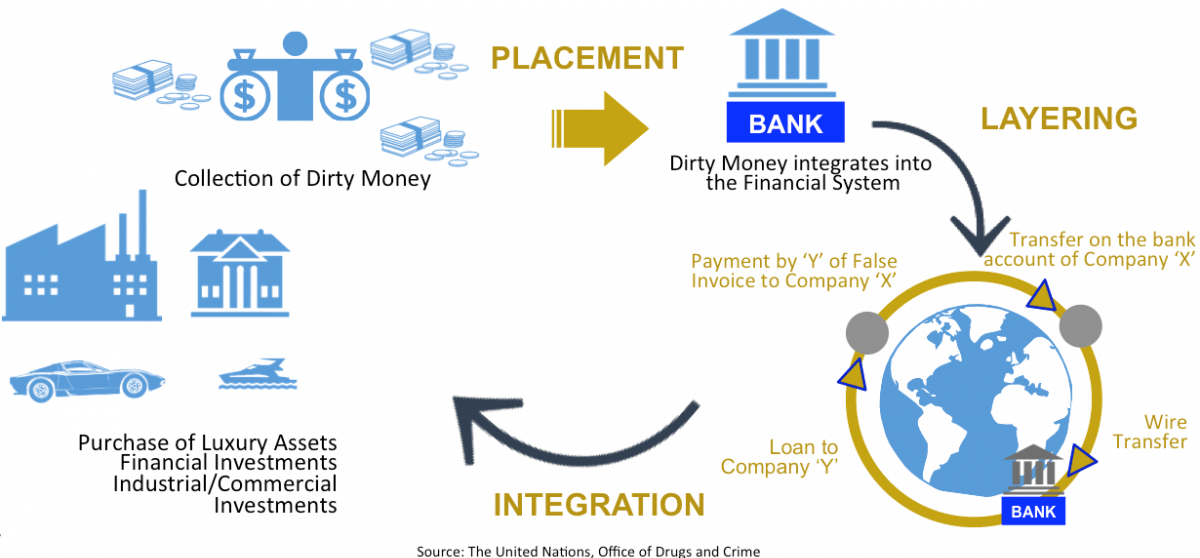

The entire money laundering activity happens through 3 different stages. The first stage is placement. In this stage the illegal money is injected into the country’s financial system.

The second is Layering stage. In this stage illegal money is separated from its source. It is a complex process. In this stage money move from one country to another or to multiple persons.

The third stage is integration. In this final stage money is returned to the criminal which looks legal money.

Illustration : Mr.X is engaged in drug trafficking. He opens multiple account with banks and deposits the money made by drug trafficking into these accounts showing as money received from his other business (placement stage). After few months, he transfers these money to Mr.Y in a foreign country or somebody else as business transaction (Layering stage). Mr.Y after few months transfer this money to Mr.X showing it as related to some legal business. Mr.X use this money to buy property, art work, jewellery or high-end automobiles and convert the whole illegally earned money into legal money (integration stage).

Impact of money laundering

It has huge impact in society and country’s economy. Few of them are,

- Crime & Corruption: Since it comes from illegal activities, it increases criminal in the society. Further to accommodate their misdeeds they need to lure people, which increases bribery and corruption.

- Country’s reputation: Wide spread money laundering activities, malign the image of the country in world arena. There are many countries who are known for such activities.

- Economy: It affects the economy of a country in an adverse way. It destabilize the financial system. Inflation goes up. Trade deficit become imbalance.

- Compromised private sector: Money launders use ‘front companies or shell companies’ to carry out their illegal activities. Thereby private sector comes under undue scan of Government.

International initiatives

Money laundering is no longer specific to certain country. It’s a worldwide phenomenon. Therefore a number of international initiative have been taken to curb it, Few of them are,

- The UN or the Bank for International Settlements, took some initiatives in 1980’s to address the problem of money laundering.

- The Financial Action Task Force (FATF) was created in 1989. The European Union, Council of Europe and organization of American States also established anti-money laundering standards for their member countries.

- UN Convention against Illicit Trafficking in Drugs and Psychotropic Substances (the Vienna Convention) and Council of Europe Convention on Laundering, Search, Seizure and Confiscation of the Proceeds of Crime are two major initiatives.

- The Basle Committee on Banking Regulation Supervisory Practices, the European Union and the International Organization of Securities Commissions also pronounced its role in preventing and detecting money laundering.

- UN also has implemented a global programme against money laundering. It provides means to combat by different countries and institutions. It encompasses,

- technical co-operation,

- research and analysis and

- Financial investigation service

Indian initiatives

In order to enact a comprehensive law India adopted Prevention of Money Laundering Act, 2002. The Act has come in force with effect from July 1, 2005.

The objectives of the Act are,

- To prevent and control.

- To confiscate and seize the property derived from, or involved in, money-laundering.

- To provide punishment for offence of money-laundering.

- To appoint the Adjudicating Authority and Appellate Tribunal to deal the matter connected with money laundering.

- To put obligations on banking companies, financial institutions and intermediaries to maintain records.

- To deal with any other issue connected with money laundering in India.

The scope of the Act are

The Money Laundering Act, 2002 extends to the whole of India. It covers all illegal activities for the purpose of money laundering including cryptocurrency trading, safekeeping and related financial services. On May 3, 2023 the government has brought services of chartered accountants (CA), company secretaries (CS) and cost and work accountants (CWA) also under the ambit of this Act.

Offence of Money Laundering

Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected proceeds of crime including its concealment, possession, acquisition or use and projecting or claiming it as untainted property shall be guilty of offence of money-laundering.

Punishment for money laundering

Whoever commits the offence of money-laundering shall be punishable with rigorous imprisonment for 3 years which may extend to 7 years and shall also be liable to fine.

However, where the proceeds of crime involved in money laundering relates to any offence specified under the Narcotic Drugs & Psychotropic Substances Act, 1985 the punishment may extend to rigorous imprisonment for 10 years instead of 7 years.

I hope you will find this article useful for basic understanding about money laundering. If you did, please share it with your friends and family and help us reach more people. If you have any questions or you need clarification on what I have written here, do ask in the comment section below, and I will be happy to respond.